It’s one of the most bewildering paradoxes of modern Canadian life: we complain endlessly about housing affordability, yet we collectively cling to the idea that higher prices are somehow good. Politicians invoke market stability, financial advisors cite “wealth-building,” and real estate headlines gleam with eye-popping median sale prices. High home prices are framed as an achievement, a milestone, and a badge of economic sophistication.

Dec 11, 2025

Expert Guides for Smart Moves

Explore our curated guides to navigate Metro Vancouver’s real estate with confidence. Whether you’re buying, selling, exploring neighborhoods, or learning about home styles, each guide is packed with insight, strategy, and practical tips — the same clarity and honesty behind Victoria Estate Digest.

Canada’s housing market has a secret few talk about openly: the same property can be leveraged again and again, turning a single home into a multi-million-dollar wealth machine for those who know how to play the system. While first-time buyers stare at median prices and give up hope, seasoned homeowners quietly extract cash from their properties, reinvest, and watch the system reward them—tax-free.

Dec 11, 2025

Canada’s housing market has a secret few talk about openly: the same property can be leveraged again and again, turning a single home into a multi-million-dollar wealth machine for those who know how to play the system. While first-time buyers stare at median prices and give up hope, seasoned homeowners quietly extract cash from their properties, reinvest, and watch the system reward them—tax-free.

Dec 11, 2025

Canada’s housing market has a secret few talk about openly: the same property can be leveraged again and again, turning a single home into a multi-million-dollar wealth machine for those who know how to play the system. While first-time buyers stare at median prices and give up hope, seasoned homeowners quietly extract cash from their properties, reinvest, and watch the system reward them—tax-free.

Dec 11, 2025

Once hailed as a convenient financial tool to unlock home equity, HELOCs are now fueling a risky addiction: using homes as giant credit cards to fund consumption, cover bills, and even prop up fragile lifestyles. As interest rates climb and the cost of borrowing balloons, many Canadians are waking up to a harsh reality — their dream home has turned into a debt trap.

Aug 3, 2025

For fifteen dizzying years, the condominium was British Columbia’s unofficial retirement fund, speculative play, and immigration gateway. And yet, what triggered this 2025 volte-face? The collapse is not a single-cause event but a perfect-storm convergence of five structural shocks. This two-part deep dive dissects each factor to explain why the investor’s love affair with B.C. condos has soured—and what that means for every stakeholder in the housing ecosystem.

Aug 7, 2025

Welcome to the Jungle: You’re a Home Seller Now. The guide for anyone brave enough to list their home in a Canadian market that has absolutely lost its mind. You’re not just selling a property. You’re stepping into a gladiator arena. A place where buyers come armed with Pinterest boards, inflated expectations, doom-scroll opinions from TikTok analysts, and budgets that don’t match their demands.

Nov 21, 2025

Welcome to the Jungle: You’re a Home Seller Now. The guide for anyone brave enough to list their home in a Canadian market that has absolutely lost its mind. You’re not just selling a property. You’re stepping into a gladiator arena. A place where buyers come armed with Pinterest boards, inflated expectations, doom-scroll opinions from TikTok analysts, and budgets that don’t match their demands.

Nov 21, 2025

Victoria Estate Digest is your Go-to source for In-Depth Real Estate Insights, Market Trends, and Expert Analysis in British Columbia.

We cover everything from Housing Affordability and Foreign Investment to Luxury Properties and Emerging Market Opportunities.

Whether you're a Buyer, Seller, or Investor, we provide the Research and Knowledge you need to navigate BC’s ever-changing Real Estate Landscape.

Victoria Estate Digest is your Go-to source for In-Depth Real Estate Insights, Market Trends, and Expert Analysis in British Columbia.

We cover everything from Housing Affordability and Foreign Investment to Luxury Properties and Emerging Market Opportunities.

Whether you're a Buyer, Seller, or Investor, we provide the Research and Knowledge you need to navigate BC’s ever-changing Real Estate Landscape.

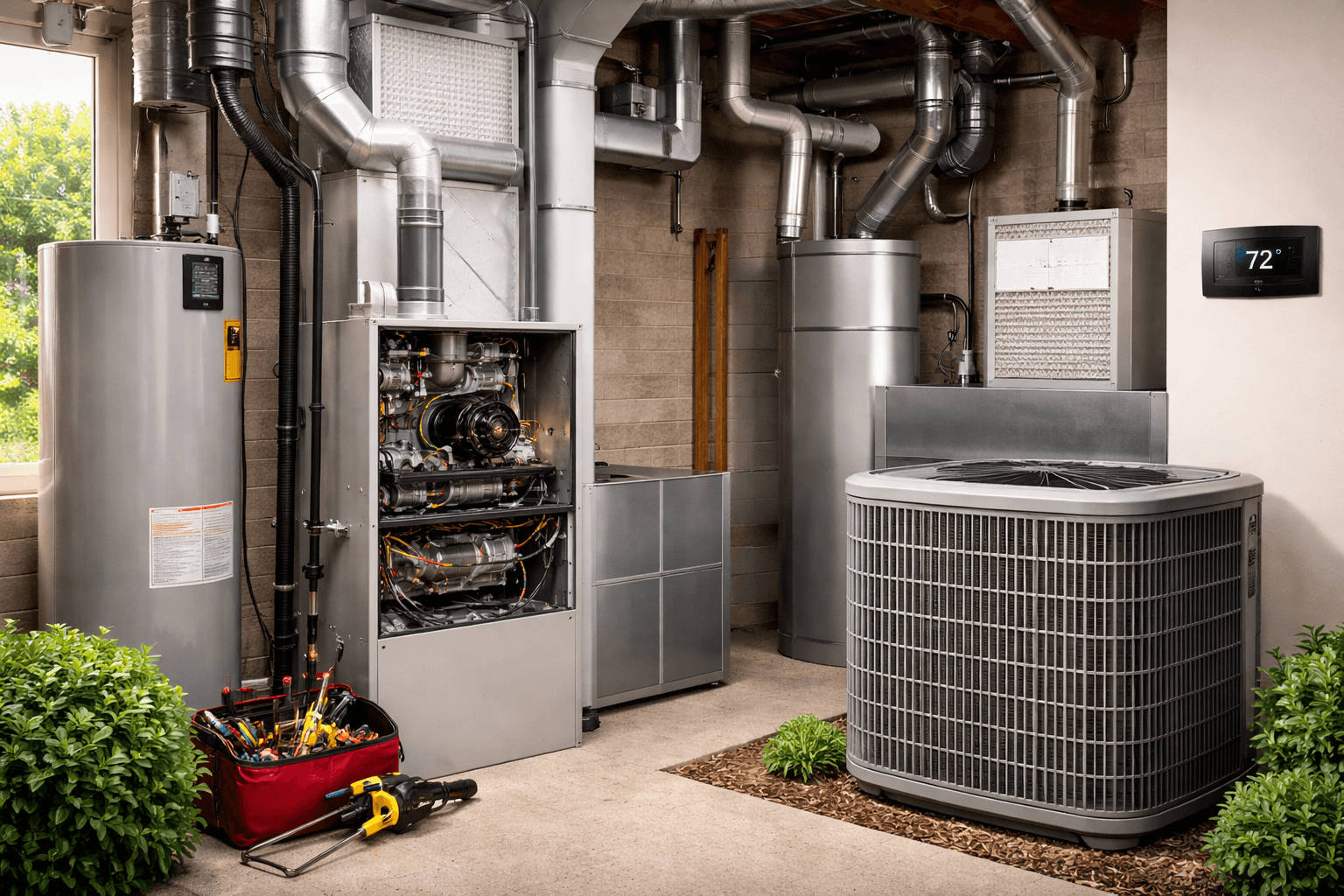

How Homes Work: Guides & Insights

Dive into guides that show what really matters in a house, from construction and materials to design choices and practical usability. Learn what questions to ask, what to watch for, and how to spot hidden issues so every feature—from tennis courts and home gyms to outdoor spaces and custom rooms—delivers the value it promises. These guides give the knowledge to assess every detail like an insider and avoid costly surprises.

Your Preferences

Your Preferences

Your Preferences

Don`t Know What to Go With?

Real estate decisions are easier when you know yourself and the market. Take our interactive quizzes to uncover your home personality, discover the styles that suit you, and understand your home’s value. Each quiz gives actionable insight and helps you make smarter, more confident real estate decisions.

Welcome to the Jungle: You’re a Home Seller Now. The guide for anyone brave enough to list their home in a Canadian market that has absolutely lost its mind. You’re not just selling a property. You’re stepping into a gladiator arena. A place where buyers come armed with Pinterest boards, inflated expectations, doom-scroll opinions from TikTok analysts, and budgets that don’t match their demands.

Nov 21, 2025

Welcome to the Jungle: You’re a Home Seller Now. The guide for anyone brave enough to list their home in a Canadian market that has absolutely lost its mind. You’re not just selling a property. You’re stepping into a gladiator arena. A place where buyers come armed with Pinterest boards, inflated expectations, doom-scroll opinions from TikTok analysts, and budgets that don’t match their demands.

Nov 21, 2025

Canada is at a crossroads. Cities from coast to coast are facing the same question: should zoning exist to preserve neighborhoods, or to solve a housing crisis? What started as a technical planning debate has exploded into a full-blown political minefield, with homeowners, developers, and municipal councils all vying for control. Today, zoning is no longer just about land—it’s about power, money, and who gets a chance to live in a city.

Dec 11, 2025

Canada is at a crossroads. Cities from coast to coast are facing the same question: should zoning exist to preserve neighborhoods, or to solve a housing crisis? What started as a technical planning debate has exploded into a full-blown political minefield, with homeowners, developers, and municipal councils all vying for control. Today, zoning is no longer just about land—it’s about power, money, and who gets a chance to live in a city.

Dec 11, 2025

It’s one of the most bewildering paradoxes of modern Canadian life: we complain endlessly about housing affordability, yet we collectively cling to the idea that higher prices are somehow good. Politicians invoke market stability, financial advisors cite “wealth-building,” and real estate headlines gleam with eye-popping median sale prices. High home prices are framed as an achievement, a milestone, and a badge of economic sophistication.

Dec 11, 2025

Find Your Perfect Community

British Columbia isn’t just one of Canada’s most beautiful provinces — it’s a mosaic of communities, each with its own rhythm, history, and appeal. From ocean-view enclaves and forested suburbs to cultural hubs and family-friendly pockets, every neighborhood tells a story about the kind of life you can build there.

Whether you’re searching for your first home, your next investment, or simply a better sense of “what fits,” this guide helps you understand the true personality of BC’s most sought-after areas — beyond the listings and glossy brochures.

For your comfort, we’ve organized BC’s communities into groups that reflect different ways of living. Whether you thrive on city energy, coastal calm, or quiet family life, this guide helps you explore areas that match your rhythm, values, and lifestyle. Think of it as your shortcut to discovering where you’ll truly feel at home.

Urban Core

Communities

Urban Core

Communities

High-rise living, walkable streets, and immediate access to shops, restaurants, and transit.

Waterfront & Coastal Communities

Waterfront & Coastal Communities

Seaside or lakeside living with scenic views, beaches, and outdoor recreation opportunities.

Family-Oriented

Suburbs

Family-Oriented

Suburbs

Quiet streets, parks, schools, and family-friendly amenities. Communities designed for growth and long-term living.

Historic & Character Neighbourhoods

Historic & Character Neighbourhoods

Older areas with heritage homes, tree-lined streets, and a strong sense of identity.

Nature-Adjacent Communities

Nature-Adjacent Communities

Hillsides, mountain views, and proximity to parks or trails. Areas that balance privacy with access to outdoor recreation.

Established & Luxury Communities

Established & Luxury Communities

Mature, well-planned neighbourhoods with premium homes, privacy, and long-standing infrastructure.

Behind the scenes, a quieter mechanism reshaped the market: the ability to repeatedly borrow against rising home values and redeploy that credit into more real estate. It was elegant. It was legal. And it created one of the most powerful demand accelerators modern housing markets have ever seen.

Feb 23, 2026

Behind the scenes, a quieter mechanism reshaped the market: the ability to repeatedly borrow against rising home values and redeploy that credit into more real estate. It was elegant. It was legal. And it created one of the most powerful demand accelerators modern housing markets have ever seen.

Feb 23, 2026

Behind the scenes, a quieter mechanism reshaped the market: the ability to repeatedly borrow against rising home values and redeploy that credit into more real estate. It was elegant. It was legal. And it created one of the most powerful demand accelerators modern housing markets have ever seen.

Feb 23, 2026

Home Style Guide

Home Style Guide

Home Style Guide

Find Your Architectural Match

Get to know the architecture that shapes BC’s neighborhoods. Whether you’re drawn to the clean lines of contemporary design, the warmth of craftsman charm, or the elegance of heritage estates, understanding style helps you recognize value, quality, and the feeling of “home.”

News

View All

It’s the headline that gets picked up by news anchors, copy-pasted into realtor newsletters, and quoted at dinner tables by optimistic uncles who swear “now’s the time to buy.” But here’s the trick: once you actually scroll past the cheery quotes and flip to the numbers — the tables buried in the back of the PDF — the vibe shifts.

Sep 4, 2025

Two open letters landed on Prime Minister Mark Carney’s desk. One, from B.C.'s largest developers, urges a return to foreign capital to maintain condo supply. The other, penned by 27 housing academics and planners, calls for rejecting speculation and investing in long-term affordability. Their messages present starkly different futures. This article unpacks both worlds in depth.

Aug 5, 2025

Two open letters landed on Prime Minister Mark Carney’s desk. One, from B.C.'s largest developers, urges a return to foreign capital to maintain condo supply. The other, penned by 27 housing academics and planners, calls for rejecting speculation and investing in long-term affordability. Their messages present starkly different futures. This article unpacks both worlds in depth.

Aug 5, 2025

Two open letters landed on Prime Minister Mark Carney’s desk. One, from B.C.'s largest developers, urges a return to foreign capital to maintain condo supply. The other, penned by 27 housing academics and planners, calls for rejecting speculation and investing in long-term affordability. Their messages present starkly different futures. This article unpacks both worlds in depth.

Aug 5, 2025

Province weighs removing supportive-housing sites from B.C.’s Residential Tenancy Act, giving operators power to evict violent or disruptive tenants within days. On a stormy Monday afternoon outside the Legislature, Housing Minister Ravi Kahlon broke political cover. Asked whether violent or persistently disruptive tenants in provincially funded supportive-housing sites could be evicted faster, he didn’t deliver the usual talking points about “balanced approaches” or “ongoing reviews.”

Aug 5, 2025

Province weighs removing supportive-housing sites from B.C.’s Residential Tenancy Act, giving operators power to evict violent or disruptive tenants within days. On a stormy Monday afternoon outside the Legislature, Housing Minister Ravi Kahlon broke political cover. Asked whether violent or persistently disruptive tenants in provincially funded supportive-housing sites could be evicted faster, he didn’t deliver the usual talking points about “balanced approaches” or “ongoing reviews.”

Aug 5, 2025

Province weighs removing supportive-housing sites from B.C.’s Residential Tenancy Act, giving operators power to evict violent or disruptive tenants within days. On a stormy Monday afternoon outside the Legislature, Housing Minister Ravi Kahlon broke political cover. Asked whether violent or persistently disruptive tenants in provincially funded supportive-housing sites could be evicted faster, he didn’t deliver the usual talking points about “balanced approaches” or “ongoing reviews.”

Aug 5, 2025

Latest

For two decades, policymakers, banks, developers, and investors collectively constructed a housing ecosystem that treats vertical living not as a way to house people, but as a way to warehouse capital. The result is a market where the dominant product — small investor-owned units — is structurally misaligned with the needs of actual households.

For two decades, policymakers, banks, developers, and investors collectively constructed a housing ecosystem that treats vertical living not as a way to house people, but as a way to warehouse capital. The result is a market where the dominant product — small investor-owned units — is structurally misaligned with the needs of actual households.

For two decades, policymakers, banks, developers, and investors collectively constructed a housing ecosystem that treats vertical living not as a way to house people, but as a way to warehouse capital. The result is a market where the dominant product — small investor-owned units — is structurally misaligned with the needs of actual households.

At first glance, Canada and the United States appear similar: wealthy North American nations, highly developed real estate markets, and historically rising home values. But scratch beneath the surface, and the differences in tax policy between the two countries are staggering. These differences shape who buys, what they buy, and how they profit—or fail—in residential and investment real estate.

At first glance, Canada and the United States appear similar: wealthy North American nations, highly developed real estate markets, and historically rising home values. But scratch beneath the surface, and the differences in tax policy between the two countries are staggering. These differences shape who buys, what they buy, and how they profit—or fail—in residential and investment real estate.

At first glance, Canada and the United States appear similar: wealthy North American nations, highly developed real estate markets, and historically rising home values. But scratch beneath the surface, and the differences in tax policy between the two countries are staggering. These differences shape who buys, what they buy, and how they profit—or fail—in residential and investment real estate.

Canada’s housing market has a secret few talk about openly: the same property can be leveraged again and again, turning a single home into a multi-million-dollar wealth machine for those who know how to play the system. While first-time buyers stare at median prices and give up hope, seasoned homeowners quietly extract cash from their properties, reinvest, and watch the system reward them—tax-free.

Canada’s housing market has a secret few talk about openly: the same property can be leveraged again and again, turning a single home into a multi-million-dollar wealth machine for those who know how to play the system. While first-time buyers stare at median prices and give up hope, seasoned homeowners quietly extract cash from their properties, reinvest, and watch the system reward them—tax-free.

Canada’s housing market has a secret few talk about openly: the same property can be leveraged again and again, turning a single home into a multi-million-dollar wealth machine for those who know how to play the system. While first-time buyers stare at median prices and give up hope, seasoned homeowners quietly extract cash from their properties, reinvest, and watch the system reward them—tax-free.

By sheltering mortgage interest and capital gains from taxation in most circumstances, the system has created a feedback loop where homeownership is financially decoupled from economic reality, incentivizing borrowing, speculation, and household debt beyond sustainable levels. This article explores how Canada’s tax treatment of homeownership disconnects people from the true cost of buying a home, amplifies risk in the housing market, and systematically discourages financial literacy among homeowners.

By sheltering mortgage interest and capital gains from taxation in most circumstances, the system has created a feedback loop where homeownership is financially decoupled from economic reality, incentivizing borrowing, speculation, and household debt beyond sustainable levels. This article explores how Canada’s tax treatment of homeownership disconnects people from the true cost of buying a home, amplifies risk in the housing market, and systematically discourages financial literacy among homeowners.

By sheltering mortgage interest and capital gains from taxation in most circumstances, the system has created a feedback loop where homeownership is financially decoupled from economic reality, incentivizing borrowing, speculation, and household debt beyond sustainable levels. This article explores how Canada’s tax treatment of homeownership disconnects people from the true cost of buying a home, amplifies risk in the housing market, and systematically discourages financial literacy among homeowners.

From SkyTrain corridors to West Vancouver estates, neighbourhood groups, provincial mandates, and city councils are locked in a struggle over how this region grows — and who gets to live here. Beneath the surface of housing targets, transit plans, and provincial bills lies a raw political truth: housing reform isn’t just technical — it’s emotional, territorial, and existential.

From SkyTrain corridors to West Vancouver estates, neighbourhood groups, provincial mandates, and city councils are locked in a struggle over how this region grows — and who gets to live here. Beneath the surface of housing targets, transit plans, and provincial bills lies a raw political truth: housing reform isn’t just technical — it’s emotional, territorial, and existential.

From SkyTrain corridors to West Vancouver estates, neighbourhood groups, provincial mandates, and city councils are locked in a struggle over how this region grows — and who gets to live here. Beneath the surface of housing targets, transit plans, and provincial bills lies a raw political truth: housing reform isn’t just technical — it’s emotional, territorial, and existential.

Strata living is often sold as a perfect blend of community, shared costs, and urban convenience. But navigating strata life is not just about buying a unit and paying your fees. It’s about understanding a complex framework of rights, duties, governance structures, legal obligations, potential conflicts, and mechanisms for dispute resolution.

Strata living is often sold as a perfect blend of community, shared costs, and urban convenience. But navigating strata life is not just about buying a unit and paying your fees. It’s about understanding a complex framework of rights, duties, governance structures, legal obligations, potential conflicts, and mechanisms for dispute resolution.

Strata living is often sold as a perfect blend of community, shared costs, and urban convenience. But navigating strata life is not just about buying a unit and paying your fees. It’s about understanding a complex framework of rights, duties, governance structures, legal obligations, potential conflicts, and mechanisms for dispute resolution.

It’s one of the most bewildering paradoxes of modern Canadian life: we complain endlessly about housing affordability, yet we collectively cling to the idea that higher prices are somehow good. Politicians invoke market stability, financial advisors cite “wealth-building,” and real estate headlines gleam with eye-popping median sale prices. High home prices are framed as an achievement, a milestone, and a badge of economic sophistication.

It’s one of the most bewildering paradoxes of modern Canadian life: we complain endlessly about housing affordability, yet we collectively cling to the idea that higher prices are somehow good. Politicians invoke market stability, financial advisors cite “wealth-building,” and real estate headlines gleam with eye-popping median sale prices. High home prices are framed as an achievement, a milestone, and a badge of economic sophistication.

It’s one of the most bewildering paradoxes of modern Canadian life: we complain endlessly about housing affordability, yet we collectively cling to the idea that higher prices are somehow good. Politicians invoke market stability, financial advisors cite “wealth-building,” and real estate headlines gleam with eye-popping median sale prices. High home prices are framed as an achievement, a milestone, and a badge of economic sophistication.

Canada is at a crossroads. Cities from coast to coast are facing the same question: should zoning exist to preserve neighborhoods, or to solve a housing crisis? What started as a technical planning debate has exploded into a full-blown political minefield, with homeowners, developers, and municipal councils all vying for control. Today, zoning is no longer just about land—it’s about power, money, and who gets a chance to live in a city.

Canada is at a crossroads. Cities from coast to coast are facing the same question: should zoning exist to preserve neighborhoods, or to solve a housing crisis? What started as a technical planning debate has exploded into a full-blown political minefield, with homeowners, developers, and municipal councils all vying for control. Today, zoning is no longer just about land—it’s about power, money, and who gets a chance to live in a city.

Canada is at a crossroads. Cities from coast to coast are facing the same question: should zoning exist to preserve neighborhoods, or to solve a housing crisis? What started as a technical planning debate has exploded into a full-blown political minefield, with homeowners, developers, and municipal councils all vying for control. Today, zoning is no longer just about land—it’s about power, money, and who gets a chance to live in a city.

If you listen closely—past the marketing slogans, past the “buy now or be priced out forever,” past the flustered mortgage brokers insisting rates will drop any quarter now—you can hear it. A soft hiss. A slow exhale. The unmistakable sound of air leaving a balloon that was inflated far beyond what physics, common sense, or household incomes should allow.

If you listen closely—past the marketing slogans, past the “buy now or be priced out forever,” past the flustered mortgage brokers insisting rates will drop any quarter now—you can hear it. A soft hiss. A slow exhale. The unmistakable sound of air leaving a balloon that was inflated far beyond what physics, common sense, or household incomes should allow.

If you listen closely—past the marketing slogans, past the “buy now or be priced out forever,” past the flustered mortgage brokers insisting rates will drop any quarter now—you can hear it. A soft hiss. A slow exhale. The unmistakable sound of air leaving a balloon that was inflated far beyond what physics, common sense, or household incomes should allow.

For most of modern history, Canadian housing was a simple story: you rent a place, you save a down payment, you buy a home, you stay. That arc defined middle‑class life. But over the past decade, that narrative has fractured under the weight of astronomically high prices, stagnant wages, tight supply, and generational inequality.

For most of modern history, Canadian housing was a simple story: you rent a place, you save a down payment, you buy a home, you stay. That arc defined middle‑class life. But over the past decade, that narrative has fractured under the weight of astronomically high prices, stagnant wages, tight supply, and generational inequality.

For most of modern history, Canadian housing was a simple story: you rent a place, you save a down payment, you buy a home, you stay. That arc defined middle‑class life. But over the past decade, that narrative has fractured under the weight of astronomically high prices, stagnant wages, tight supply, and generational inequality.

Recent

Recent

Recent

Guides

Guides

Guides

Key Insights

Key Insights

Key Insights